Cadana InstantPay, a win-win for Employers and Employees

Life is unpredictable. Children get sick, cars break down and random bills come up at the most inconvenient times. When unexpected expenses occur before payday, workers are financially stressed because they have few options to obtain money. This leads to depreciating health (more bills), as well as, poor engagement and productivity at work. We’ve built Cadana InstantPay to solve this problem for millions of African workers. Our award-winning solution allows employees to access their earned salaries on-demand instead of waiting till the end of the month.

The Problem - Employees

Over the last decade, real wages in Sub-Saharan Africa have remained stagnant while the costs of goods and services like food, healthcare, transportation, and education have skyrocketed. In the last year alone, costs have further worsened with food prices for example soaring to double-digit inflation at 11%. As a result, workers need money to make ends meet, especially in these dire times of COVID 19. Lacking savings, bank overdraft facilities, or credit cards, millions of African workers suffer from financial stress when unexpected expenses occur. They borrow money from payday lenders who charge upwards of 300% APY and leave them in a debt trap that takes months, sometimes years to get out of. Aside from payday lenders, workers seek money from colleagues, friends, and family, a process that can be very lengthy and often embarrassing.

The Problem - Employers

Employee financial stress is costing businesses time and money. Employers spend about 33% of an employee’s annual salary to replace them when they leave the organization. This is due to costs from screening, hiring, training, and productivity losses while positions remain open for long periods of time. Replacements costs are compounded in high turnover industries such as retail, travel and hospitality, grocers and supermarkets, and call centers where turnover can be as high as 20%. Furthermore, with the global pandemic, employers are looking for innovative ways to further support their employees. According to PwC, when employees are stressed, they spend 5+ hours each week at work dealing with their financial issues. This means businesses are losing money in productivity losses due to employee financial stress.

The Solution

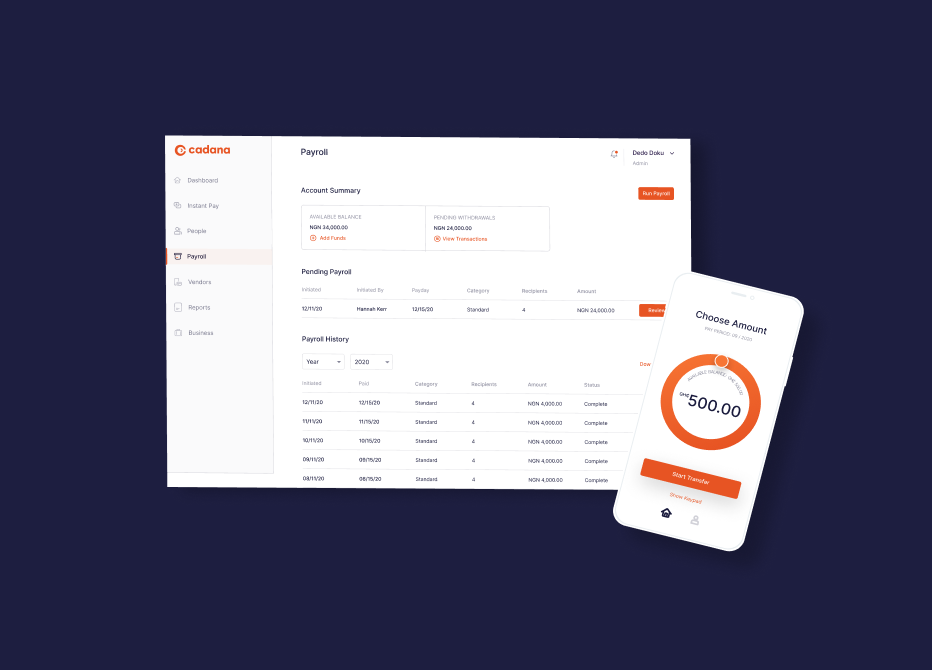

Cadana InstantPay, empowers employees, salaried workers or contractors to withdraw a percentage, pre-set by the company, of their real-time earnings and instantly transfer it to their bank or mobile money account. This solution is also known as Earned Wage Access (EWA). Prior to Cadana InstantPay, employees relied on predatory and expensive payday lenders for short-term liquidity. Moreover, employers that offered salary advances or cooperatives loans for their employees spent tens of hours each year administering loans to workers.

With Cadana, access to pay is streamlined for both the employer and employee. For employers, Cadana fronts the risk so employers’ working capital is not impacted. Additionally, onboarding is simple for businesses. Cadana integrates with the employer’s existing payroll, HRMS, ERP solution so they do not have to change any of their current processes. For employers that do not have an automated payroll platform, we’ve got you covered. Cadana offers a spend and employee management platform, Cadana BusinessPlus, that allows businesses to streamline payroll, vendor payments, and invoice management all in one place.

For employees getting your money is as easy as 1,2,3. First, you enter the amount you want. Next, you confirm the payout method you want to receive your money (bank or momo). And voila, you get your cash instantly.

Why Now?

Now more than ever, businesses must attract, hire and retain the best talent to stay innovative. The best workers are demanding flexible work contexts, especially regarding their finances. The Coronavirus pandemic has further highlighted the need for flexibility in the workforce. Businesses and brands will be judged, in these dire times, by the steps they take to support and improve the financial wellness of their people.

Employee retention and positive work culture are critical to maintaining business growth and profitability. Cadana is the first step towards financial inclusivity - and we will help you take the leap. Book a demo now to learn more.

What’s Next?

We believe the future of compensation is real-time, flexible, and borderless. Cadana InstantPay is just the start. In the coming months, we are announcing even more innovative features that empower employees on their journies to financial wellness. Stay tuned!